Rechercher dans ce blog

Tuesday, November 30, 2021

Monday, November 29, 2021

A look at the economics behind food deserts - 9News.com KUSA

[unable to retrieve full-text content]

A look at the economics behind food deserts 9News.com KUSAA look at the economics behind food deserts - 9News.com KUSA

Read More

EU reaches for hydrogen stars as economics shift - WSAU News

By Isla Binnie

MADRID (Reuters) -The cost of producing green hydrogen with renewable energy is set to fall and the capacity to produce it in Europe and nearby countries will likely surpass current targets by 2030, European Union officials said on Monday.

Countries and companies have seized on green hydrogen – a fuel obtained by passing renewably-produced electricity through water to split the element from oxygen – as a way to cut greenhouse gas emissions, especially from heavy industry.

Until now, green hydrogen has been far more expensive than versions produced using fossil fuel, including the dominant “grey” hydrogen https://ift.tt/3Da9wqS that relies on natural gas.

But high gas prices due to strong demand and lower stocks have driven up the cost of making the carbon-emitting version, meaning the cleaner technology can start to compete, European Commission President Ursula von der Leyen said at an event in Brussels.

The cost of emitting carbon under the EU’s trading system has also hit record highs, further increasing the cost of emissions-heavy fuels and providing an incentive to move away from them, potentially allowing production of green hydrogen to reach the scale that becomes more economic.

“Because of the current rise in gas prices that we see, green hydrogen today can even be cheaper than grey hydrogen,” von der Leyen told an event in Brussels.

In 2020, grey hydrogen could be produced for around 2 euros ($2.26) per kilogram, compared to as much as 6 euros per kilo for the green version, industry estimates found.

Von der Leyen said green hydrogen could cost less than 1.8 euros per kilogram by 2030. “This goal is within reach,” she said.

The target hinges on a vast increase in production capacity, from the roughly 0.3 gigawatts (GW) of electrolysers that the International Energy Agency (IEA) counts around the world.

EU climate policy chief Frans Timmermans said he expected the EU and its neighbours to surpass a target to install 40 GW within the bloc and a further 40 GW in other countries to the east and south by 2030.

“While the dynamics are there, let’s be honest we still need to do a lot,” Timmermans told the same Brussels event, adding the bloc should rise to the challenge.

“The stars are made of hydrogen, so let’s reach for the stars,” he said.

Among the bloc’s neighbouring countries, Ukraine and Morocco are the most active on the issue, an EU official said.

Hydrogen demand was roughly 90 million tonnes in 2020, the vast majority of which was produced using fossil fuel energy, resulting in close to 900 million tonnes of CO2 emissions, the IEA said.

Opponents of the hydrogen drive say it is inefficient because to scale up, it will require vast amounts of clean energy production and future cost reductions are uncertain.

Environmental campaigners also see it as an excuse to prolong the use of fossil fuels.

($1 = 0.8863 euros)

(Reporting by Isla Binnie; additional reporting by Vera Eckert in Frankfurt;Editing by Gareth Jones and Barbara Lewis)

EU reaches for hydrogen stars as economics shift - WSAU News

Read More

Yes, home economics classes still exist | Local News | thesheridanpress.com - The Sheridan Press

SHERIDAN — Sheridan County School District 2 Assistant Superintendent for Curriculum and Instruction Mitch Craft wants to bust a myth in the Sheridan community: home economics classes still exist, they just have a new name.

Career technical education, or CTE.

While disguised under an updated title, Craft said the courses provided under this umbrella translate to real-world preparedness for students at Sheridan High School. Through the 12 CTE tracks offered at SHS, students who complete an entire track will receive a certification in that particular field. For example, students participating in the business accounting CTE track receive a certification in QuickBooks, a training Craft said applies to most office jobs.

“The nomenclature has changed, but the essence of the programs really has not,” Craft said. “These are designed to give our students a foothold in the workplace and/or college or some higher education after high school that’s specifically focused on preparing them for a career.

“Vocational education is very much alive at Sheridan High School and across the country, just under a different name: career and technical education,” he added.

CTE Department Chair Heidi Richins coordinates faculty and students in numerous ways, one of which guides them through practical application of their CTE courses through internships in the community. Students receive credit counting toward graduation while also obtaining real-world experience in a job of particular interest. Sometimes, Richins said, students realize they are on the right path toward a career, while others realize through the internship they should look toward a different path. Either way, students and businesses benefit from the relationship.

That relationship folds into the CTE program, too. As a requirement through Perkins V, school administrators must consult with local businesses to ensure available elective courses through the CTE tracks directly benefit the community and students in pursuing careers in those particular fields. Feedback can be obtained in many different ways, Craft said, with some of them including formal feedback through surveys or others through feedback from businesses hosting interns from SHS.

“We have great community collaboration on (CTE programs) as well,” Craft said. “For every one of these pathways, we can also name individuals and businesses that we get feedback from and that support our programs. Many of them flow into Sheridan College programs.”

The 12 tracks include support services, agribusiness systems, animal systems, teaching/training, programming and software development, network systems, accounting, restaurant and food beverage management, design/pre-construction, construction, manufacturing production process DEV and production.

While other schools may provide more or fewer options for CTE tracks, Craft said after some tweaking over the years, the number of tracks available to SHS students seems to fit the district appropriately. Each track closely ties with fully established industries in Sheridan County.

In addition to business partners in the community, Craft and Richins mentioned Sheridan College as a large contributor to many of the options available for students. Each student wishing to fully invest in a certain CTE pathway may need to take courses at Sheridan College or may earn credit through concurrent enrollment through classes taught by SHS faculty certified to teach collegiate-level courses.

“Our faculty and Sheridan College faculty communicate,” Craft said. “They communicate about our programs and how our students can prepare for theirs.”

For students not wishing to fully invest in one set subject, the elective opportunities allow for hands-on learning opportunities that benefit their graduation requirements while also allowing them to gauge their interest in a particular career.

“They’re going to finish with a certification that’s recognized in the workplace,” Craft said. “That said, many of them go on to add certifications.”

Throughout the next several months, The Sheridan Press will explore each track, describing how it fits into student life at SHS as well as the greater Sheridan community.

Yes, home economics classes still exist | Local News | thesheridanpress.com - The Sheridan Press

Read More

János Kornai obituary - The Guardian

[unable to retrieve full-text content]

János Kornai obituary The GuardianJános Kornai obituary - The Guardian

Read More

EU reaches for hydrogen stars as economics shift - Reuters

/cloudfront-us-east-2.images.arcpublishing.com/reuters/DW3S2URZS5M7TN5XRRKBL6GF4I.jpg)

European Commission President Ursula von der Leyen attends a news conference in Riga, Latvia November 28, 2021. REUTERS/Ints Kalnins

Register now for FREE unlimited access to reuters.com

MADRID, Nov 29 (Reuters) - The cost of producing green hydrogen with renewable energy is set to fall and the capacity to produce it in Europe and nearby countries will likely surpass current targets by 2030, European Union officials said on Monday.

Countries and companies have seized on green hydrogen - a fuel obtained by passing renewably-produced electricity through water to split the element from oxygen - as a way to cut greenhouse gas emissions, especially from heavy industry.

Until now, green hydrogen has been far more expensive than versions produced using fossil fuel, including the dominant "grey" hydrogen that relies on natural gas. read more

Register now for FREE unlimited access to reuters.com

But high gas prices due to strong demand and lower stocks have driven up the cost of making the carbon-emitting version, meaning the cleaner technology can start to compete, European Commission President Ursula von der Leyen said at an event in Brussels.

The cost of emitting carbon under the EU's trading system has also hit record highs, further increasing the cost of emissions-heavy fuels and providing an incentive to move away from them, potentially allowing production of green hydrogen to reach the scale that becomes more economic.

"Because of the current rise in gas prices that we see, green hydrogen today can even be cheaper than grey hydrogen," von der Leyen told an event in Brussels.

In 2020, grey hydrogen could be produced for around 2 euros ($2.26) per kilogram, compared to as much as 6 euros per kilo for the green version, industry estimates found.

Von der Leyen said green hydrogen could cost less than 1.8 euros per kilogram by 2030. "This goal is within reach," she said.

The target hinges on a vast increase in production capacity, from the roughly 0.3 gigawatts (GW) of electrolysers that the International Energy Agency (IEA) counts around the world.

EU climate policy chief Frans Timmermans said he expected the EU and its neighbours to surpass a target to install 40 GW within the bloc and a further 40 GW in other countries to the east and south by 2030.

"While the dynamics are there, let's be honest we still need to do a lot," Timmermans told the same Brussels event, adding the bloc should rise to the challenge.

"The stars are made of hydrogen, so let's reach for the stars," he said.

Among the bloc's neighbouring countries, Ukraine and Morocco are the most active on the issue, an EU official said.

Hydrogen demand was roughly 90 million tonnes in 2020, the vast majority of which was produced using fossil fuel energy, resulting in close to 900 million tonnes of CO2 emissions, the IEA said.

Opponents of the hydrogen drive say it is inefficient because to scale up, it will require vast amounts of clean energy production and future cost reductions are uncertain.

Environmental campaigners also see it as an excuse to prolong the use of fossil fuels.

($1 = 0.8863 euros)

Register now for FREE unlimited access to reuters.com

Reporting by Isla Binnie; additional reporting by Vera Eckert in Frankfurt; Editing by Gareth Jones and Barbara Lewis

Our Standards: The Thomson Reuters Trust Principles.

EU reaches for hydrogen stars as economics shift - Reuters

Read More

Euro-Area Economic Confidence Retreats as Consumer Mood Slips - Bloomberg

Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast.

Economic confidence in the euro area slipped in November as consumers struggled with an inflation spike and resurgent coronavirus infections that turned the region into a pandemic hotspot yet again.

Euro-Area Economic Confidence Retreats as Consumer Mood Slips - Bloomberg

Read More

Economists Game Out How Omicron Will Hurt the Global Recovery - Bloomberg

The omicron variant is dealing a blow to optimistic hopes that the world economy would enter 2022 on a firmer footing, potentially undermining plans by policy makers to focus on inflation rather than weak demand.

The imposition of travel restrictions will shake consumer and corporate confidence, likely limiting activity in some places just as the holiday season gets underway in many economies. Japan will effectively ban the entry of all foreign visitors as part of its plan to curb the virus spread, broadcaster NTV reported.

Economists Game Out How Omicron Will Hurt the Global Recovery - Bloomberg

Read More

Sunday, November 28, 2021

UNC alumnus Justin Hadad wins Rhodes scholarship, will study economics at Oxford - The Daily Tar Heel

Justin Hadad, a 2021 UNC graduate, will become the University’s 53rd Rhodes scholar and the second of three UNC scholars named as part of the class of 2022.

The scholarship will fund Hadad’s Master of Philosophy in economics at the University of Oxford, where he hopes to continue studying market design. He is currently pursuing this discipline as a research assistant for Marek Pycia, a professor of organizational economics at the University of Zurich.

Hadad, whose parents emigrated from Trinidad and Tobago, grew up in Columbus, Ohio. His great-grandparents are refugees from Syria and Lebanon. His family background is of great importance to him, he said.

"It is a reason why I do everything," Hadad said.

Part of what brought him to UNC is its location in the South, the place "farthest out of his comfort zone," he said.

"I wanted to explore an environment so unfamiliar to me," Hadad said. "But I also wanted to do it in a place that's well-regarded not only for its academics, but also for its culture."

Hadad graduated from UNC in 2021 with an economics major and an interdisciplinary studies major in applied physics, as well as a minor in Latin.

Sharon L. James, a professor in the Department of Classics, said Hadad is a renaissance man.

“It's a rare person who brings together physics, economics, Latin, poetry and technology, and does well in all of them,” James said. “And he sees connections between them that I think the rest of us would struggle to see.”

Hadad also graduated from the University as a Morehead-Cain scholar, an Honors Carolina laureate and a member of Phi Beta Kappa.

Julie DeVoe, director of scholar advising for the Morehead-Cain program, said Hadad brings a lot of energy to all of his studies and diverse involvements.

“He also was really wonderful at recruiting others to join a cause,” DeVoe said.

This ability has served him during his undergraduate years, where he engaged in multiple entrepreneurial and collaborative pursuits.

Hadad said he spent the summer after his first year in Louisville, Ky., as a government research fellow researching policies to optimize the welfare of immigrant small-business owners.

He said his family has driven his interest in applying his studies to issues that refugees and immigrants face.

“I've found that economic theory provides a framework for analyzing humanitarian problems," Hadad said. "I found that I'm drawn to problems that affect people like my family."

During his sophomore year, he worked for a software startup called Wage, which he said focused on optimizing the matching of shifts to employees. This idea became the topic for his honors thesis at UNC.

But Hadad said his biggest accomplishment during that year was being co-founder and chief strategist for UNCUT, a media platform for sharing athlete stories off the field. He continued his work with UNCUT through his junior year.

Hadad said his most fulfilling work, though, was developing and teaching a course through the Honors Carolina C-START program. The course was run under the faculty mentorship of Daniel Young, a teaching assistant professor in the Department of Physics and Astronomy. The course covered game theory market design, microeconomic theory and introductory physics principles.

During his final year at UNC, Hadad co-founded a web-based team management tool called SplitTime, inspired by the now dissolved startup Wage.

Now, in Zurich, Hadad continues to apply his experiences and interest in market design to answer theoretical questions concerning the global refugee crisis and labor force deficits.

Looking ahead, Hadad reflected on the people and places that shaped him during his time at UNC.

"I am the sum of my community, I am nothing without the people who've been able to teach me things," he said. "I am privileged to collaborate so closely with people who are naturally inclined to share their depth of experience with a young, curious kid like me."

Hadad will begin his studies as a 2022 Rhodes scholar at Oxford next fall, alongside UNC senior Takhona Hlatshwako and fellow UNC 2021 graduate Kimathi Muiruri.

university@dailytarheel.com | elevate@dailytarheel.com

To get the day's news and headlines in your inbox each morning, sign up for our email newsletters.

UNC alumnus Justin Hadad wins Rhodes scholarship, will study economics at Oxford - The Daily Tar Heel

Read More

Top economist says supply chain issues could 'contaminate' demand | TheHill - The Hill

Mohamed El-Erian, chief economic advisor for the Allianz financial services company, said on Sunday that the main cause for concern in the U.S. economy should be supply chain issues, warning that continued problems could "contaminate" demand for products.

"Fox News Sunday" guest host Trace Gallagher noted that initial reports appeared to indicate that Black Friday sales were not particularly strong, and asked the economist if this was simply because shoppers were told to buy earlier this year in anticipation of supply chain disruptions.

"People were worried about supplies in the last two months. We saw a big jump in retail sales that came earlier than a lot of people expected, so I think quite a few people accelerated [those] purchases," said El-Erian.

"I don't think we have an issue with demand. I think incomes are strong. Retail sales are strong. Companies have lots of money. The problem is the supply side," he continued. "And unless we fix the supply side, it will contaminate the demand side. So that's why it's really important to focus on the two big issues that we have: supply disruptions and inflation."

Touching on inflation, El-Erian shot back at remarks from government officials who have characterized inflation as being "transitory."

"I think it's time for a change in policy at the Fed. And I was of the view that this may be easier with someone who hasn't repeated over and over again that inflation is transitory, don't worry about it, it's going away," El-Erian said, referring to Federal Reserve Chair Jerome Powell, who was nominated for a second term by President Biden Joe BidenGOP eyes booting Democrats from seats if House flips Five House members meet with Taiwanese president despite Chinese objections Sunday shows preview: New COVID-19 variant emerges; supply chain issues and inflation persist MORE last week.

Joe BidenGOP eyes booting Democrats from seats if House flips Five House members meet with Taiwanese president despite Chinese objections Sunday shows preview: New COVID-19 variant emerges; supply chain issues and inflation persist MORE last week.

"Inflation is not transitory and it's really important for the Fed to realize this because the worst thing that can happen is that in addition to the supply disruptions, we can't do anything about, in addition to the labor shortages, they destabilize our expectations and we change behavior even faster," he added.

Top economist says supply chain issues could 'contaminate' demand | TheHill - The Hill

Read More

Real World Economics: Biden, too, embraces tariff regime - TwinCities.com-Pioneer Press

It is hard to think of a dumber thing for any president to do than increase tariffs on a product, the price of which consumers and businesses are very aware, just at a time when that same president is

under intense political fire for rising inflation. Yet that is what the Biden administration did last week, with little fanfare in a holiday week, in raising taxes on imports of Canadian softwood lumber to 17.9 percent from 8.99 percent.

Of course there is politics in this as well. U.S. forest products producers, including ones in northern Minnesota, want greater restrictions on imports, because imports lower prices here. That is Econ 101.

Users of wood, especially home builders, want lower prices, regardless of where the wood comes from. However, unlike raw steel, of which most households buy little, many families do buy lumber for projects large and small. So increases in the prices of boards and building panels like plywood are very apparent to consumers in a way that reinforcing rods, sold at the same big box stores, are not.

Politicians juggle pressures from these two groups. Over recent decades, the U.S. lumber industry seems to have had more clout than wood users, whether consumers or businesses.

Lumber prices had a historic spike. By early 2021, builders’ associations asserted higher wood prices were adding $38,000 to the cost of the average new U.S. home. Always take industry numbers with much salt, but there was a historic spike.

Prices had trended sideways after about 2012, but had dropped 30 percent from June 2018, to June 2019. They then stayed about level until COVID hit in 2020. Initially prices then fell into a hole, falling to 2017 levels in April of last year. That short dip reversed up into a tear, roughly quadrupling in the 14 months to June 2021. Collapse was nearly as fast, falling by two-thirds in three months. For October 2021, they were right where they had been in the spring of 2018.

Much of the extreme spike resulted from millions of do-it-yourselfers, homebound by COVID, buying materials for projects. The rush accentuated as the epidemic seemed to wane into 2021. The spike in real estate markets spurred home building.

Wood producers here and in Canada, by far our largest foreign source, initially could not re-ramp production up fast enough to prevent shortages. As output rose, however, prices fell again. Caution in the face of the wave of cases caused by the delta variant has added to the slowing.

In the last two days, prices are again rising because of the just-announced import duty increases. Canadian lumber has a substantial market share, usually between a fourth and a third of total use in our country. So tariffs can sharply influence wholesale and retail prices.

Those who have studied econ understand that “elasticity” — or how production or purchases respond to price changes — always plays a role in situations like this. Both the demand for and the supply of lumber are deemed “inelastic,” especially in the short term. This means that production rises slowly in response to market price increases and amounts users are willing to buy does not change that much. That is part of why we saw the extreme fluctuations over the past three years — rising or falling prices did not disrupt demand.

Hundreds of Minnesota forest product workers will benefit from the tariffs. Hundreds of thousands of Minnesota consumers will pay more. Economists nearly always calculate a loss of overall wellbeing from events like this. But politics is politics.

The whole kerfluffle raises a few broader points. Canada is our closest ally in many ways and its economy is most integrated with ours. The cultural and social overlaps between the two nations are enormous. But trade always has its irritants and those work both ways.

Canada’s conservative party won a pivotal election in 1911 on the slogan of “no truck or trade with the Yankees!” One result was no specific U.S.-Canada trade agreement for 65 years. However, over this time, the U.S. and Canadian auto industries, then concentrated almost entirely on a Michigan-Ontario axis, had become highly integrated. We have always been very reliant on imports of Canadian aluminum.

So we were not cut off from each other. We became more integrated with CUSTA, the Canadian-U.S. Trade Agreement, negotiated at Canada’s request, that soon morphed into NAFTA when Mexico wanted in.

But President Donald Trump quickly slammed the door on cordial trade with our northern neighbor by unilaterally imposing tariffs on steel and aluminum based on specious “national defense” considerations. This was outrageous. Canada had been a faithful supplier of these metals through five important U.S. wars starting with WWI through our 1991-2021 adventures in the Persian Gulf region and Southwest Asia.

Yet Joe Biden has left nearly all the Trump tariffs in place. This raises the very broad issue of whether the World Trade Organization is dead, strangled in its crib by its midwife.

From the 1960s into the 1990s, the U.S. beat drums globally to transform the weak General Agreement on Tariffs and Trade into a stronger, more encompassing World Trade Organization. This would have real power to adjudicate trade disputes and impose penalties. We wanted it to cover agriculture, which we, ourselves, had insisted on keeping out of the GATT originally.

We got all of this — and no sector of the U.S. economy benefited more than agriculture. However, at the same time, the economy of China grew exponentially, doubling about every eight years from 1980 to 2020. This imposed political stresses on world trade.

In 2016, candidate Trump’s platform promised an effective unilateral repudiation of what seven previous presidents from both parties had struggled to get. When elected, Trump did so.

The irony of ongoing softwood disputes with Canada is that Canada had won the most recent of a badminton-like series of complaints filed with the WTO. We could appeal, but Trump had neutered the appeals court by refusing to approve any nominees to it. So we are in a position where we have unilaterally broken nearly all of the contractual trade commitments that we made to other nations over the last 30 years.

We need a national, bi-partisan conversation on what sort of trade regime we want. And there is zero chance that such a conversation will be raised by either party.

St. Paul economist and writer Edward Lotterman can be reached at stpaul@edlotterman.com.

Real World Economics: Biden, too, embraces tariff regime - TwinCities.com-Pioneer Press

Read More

Three threats to the global economic recovery - The Economist

THE NEWS, as the second anniversary of the pandemic nears, could be better. The emergence of a covid-19 variant, labelled Omicron, has sparked a wave of selling on financial markets, seemingly on concern that a new highly transmissible strain of the virus could set back economic recoveries worldwide. Yet even if Omicron proves manageable, 2022 will probably be an economically trying one, as countries are squeezed between two formidable economic forces: tighter American monetary policy and slower growth in China.

America and China loom over the global economy: together, they account for 40% of global GDP at market exchange rates. The two giants tend to influence other economies in different ways, however. For many emerging countries, strong growth in America is a double-edged sword. The expansionary effect of its households’ spending is often overshadowed by the effect of its monetary policy, given the critical role of the dollar and Treasury bonds in the global financial system. Tighter American monetary policy is often associated with a declining global risk appetite. Capital flows towards emerging markets tend to ebb; a strengthening dollar reduces trade flows because of the greenback’s role in trade invoicing.

China’s effect on the world is more straightforward. It is, by a large margin, the world’s biggest consumer of aluminium, coal, cotton and soyabeans, among other commodities, and a major importer of goods ranging from capital equipment to wine. When China falters, exporters around the world feel the pain.

The year ahead will not be the first time economies have been forced to navigate the treacherous waters between the two dangers. In the mid-2010s vulnerable emerging markets were squeezed by a rising dollar, as the Federal Reserve withdrew the monetary support provided during the global financial crisis, while a badly managed round of financial-market liberalisation and credit tightening triggered a slump in China. Growth across emerging markets, excluding China, sagged from 5.3% in 2011 to just 3.2% in 2015.

The squeeze this time could well be more painful. In the 2010s, a weak recovery and stubbornly low inflation forced the Fed to go slow. More than two-and-a-half years elapsed between the Fed’s announcement of its intention to reduce its asset purchases and the first rise in its policy rate. This time around, by contrast, the 12 months following the Fed’s announcement of its plan to begin tapering in November are likely to involve a complete halt to bond-buying and, according to market pricing, at least two interest-rate rises.

China, for its part, seems at greater risk of a hard landing today than it was a half-decade ago. Then, the government responded to slackening growth by opening the credit taps, helping reinflate a housing bubble. The property market has since become only more overextended, and the debt loads of households and firms have risen. Economic officials now deliver regular, ominous warnings about the adjustment ahead. Though the IMF still forecasts that China will grow by 5.6% in 2022, that would, with the exception of 2020, be the lowest rate since 1990.

China’s importance for the global economy has only increased since the 2010s. And the world remains vulnerable to shocks. Debt loads soared during the pandemic; the continued spread of covid-19 is likely to place further demands on governments. Analysis of past episodes of Fed tightening suggests that an increase in interest rates prompted by strong American demand is modestly beneficial to emerging economies on a sound macroeconomic footing. But for more fragile economies, it can be destabilising.

In order to assess which places face the biggest squeeze from tighter American monetary policy, The Economist has gathered data on a few key macroeconomic variables for 60 large economies, both rich and developing (see chart 1). Large current-account deficits, high levels of debt (and of short-term debt owed to foreigners especially), rampant inflation and insufficient foreign-exchange reserves all spell trouble for economies facing fickle capital flows as American policy tightens.

Combining countries’ performance on these indicators yields a “vulnerability index”, on which higher scores translate into greater fragility. The pressure is already on in some places. Argentina, which tops the list, faces an inflation rate above 50% and a deepening economic crisis. Turkey’s fundamentals look a little better, but its woes are compounded by the government’s stubborn desire to lower interest rates in the face of soaring prices. The lira has been hammered, losing nearly 40% against the dollar in 2021, diminishing the purchasing power of Turks’ wages and pensions.

Very high debt loads in some rich countries push them up the list. Markets typically extend the rich world more breathing room, but if global financial conditions tighten substantially, then European leaders may need to do more to persuade punters that Greece will not be allowed to fall into serious trouble. Among big emerging economies, Brazil looks most vulnerable.

Ranking the same 60 economies by their exports to China, as a share of their own GDP, yields an index of vulnerability to the mainland. Many of the biggest exporters to China, like Singapore and South Korea, are critical links in manufacturing supply chains. These should be untroubled as China’s domestic economy slows, as long as Americans keep shopping. Flagging Chinese growth could batter Australia, which exports resources to China, and Germany, whose industrial-equipment firms depend heavily on Chinese customers. But at greater risk are the poorer commodities exporters that have helped feed China’s population and provide for its building boom.

This gauge of exposure to China can then be compared with our measure of vulnerability to American monetary-policy tightening (see chart 2). Some countries’ fates are more linked to one of the giants than the other. Others, such as Brazil and Chile, appear most likely to suffer from a double whammy. Despite high levels of debt and soaring inflation, high commodity prices have enabled Brazil to just about maintain investors’ confidence. A softening Chinese economy could deprive Brazil of that benefit, leading to a tumbling currency, even higher inflation and the possibility of economic crisis.

Conditions might worsen if tighter American monetary policy exacerbates a Chinese slowdown. Though China’s enormous pile of foreign-exchange reserves provides it with a buffer, it has also received large financial flows over the past two years, which have boosted the value of the yuan. Global banks’ claims on China surged by nearly $200bn from 2020 to 2021, to nearly $1trn. A sudden unwinding of those flows could lead to a sharp depreciation—not unlike the one that destabilised markets in the mid-2010s.

The emergence of Omicron adds fresh uncertainty. Little is known yet about the economic damage that the variant might wreak. As equity prices tumbled on November 26th, investors nudged down their expectations of the pace of American rate rises next year. But this may not bring much respite to weak economies. Many currencies tumbled against the dollar amid a flight to safety. That, if it continues, is not dissimilar to the effects of sustained American monetary tightening. If Omicron were also to depress trade and growth, then its spread would further amplify the pressures facing vulnerable economies. The sailing will be anything but smooth. ■

Three threats to the global economic recovery - The Economist

Read More

Saturday, November 27, 2021

Mythbusters: Yes, home economics classes still exist | Local News | thesheridanpress.com - The Sheridan Press

SHERIDAN — Sheridan County School District 2 Assistant Superintendent for Curriculum and Instruction Mitch Craft wants to bust a myth in the Sheridan community: home economics classes still exist, they just have a new name.

Career technical education, or CTE.

While disguised under an updated title, Craft said the courses provided under this umbrella translate to real-world preparedness for students at Sheridan High School. Through the 12 CTE tracks offered at SHS, students who complete an entire track will receive a certification in that particular field. For example, students participating in the business accounting CTE track receive a certification in QuickBooks, a training Craft said applies to most office jobs.

“The nomenclature has changed, but the essence of the programs really has not,” Craft said. “These are designed to give our students a foothold in the workplace and/or college or some higher education after high school that’s specifically focused on preparing them for a career.

“Vocational education is very much alive at Sheridan High School and across the country, just under a different name: career and technical education,” he added.

CTE Department Chair Heidi Richins coordinates faculty and students in numerous ways, one of which guides them through practical application of their CTE courses through internships in the community. Students receive credit counting toward graduation while also obtaining real-world experience in a job of particular interest. Sometimes, Richins said, students realize they are on the right path toward a career, while others realize through the internship they should look toward a different path. Either way, students and businesses benefit from the relationship.

That relationship folds into the CTE program, too. As a requirement through Perkins V, school administrators must consult with local businesses to ensure available elective courses through the CTE tracks directly benefit the community and students in pursuing careers in those particular fields. Feedback can be obtained in many different ways, Craft said, with some of them including formal feedback through surveys or others through feedback from businesses hosting interns from SHS.

“We have great community collaboration on (CTE programs) as well,” Craft said. “For every one of these pathways, we can also name individuals and businesses that we get feedback from and that support our programs. Many of them flow into Sheridan College programs.”

The 12 tracks include support services, agribusiness systems, animal systems, teaching/training, programming and software development, network systems, accounting, restaurant and food beverage management, design/pre-construction, construction, manufacturing production process DEV and production.

While other schools may provide more or fewer options for CTE tracks, Craft said after some tweaking over the years, the number of tracks available to SHS students seems to fit the district appropriately. Each track closely ties with fully established industries in Sheridan County.

In addition to business partners in the community, Craft and Richins mentioned Sheridan College as a large contributor to many of the options available for students. Each student wishing to fully invest in a certain CTE pathway may need to take courses at Sheridan College or may earn credit through concurrent enrollment through classes taught by SHS faculty certified to teach collegiate-level courses.

“Our faculty and Sheridan College faculty communicate,” Craft said. “They communicate about our programs and how our students can prepare for theirs.”

For students not wishing to fully invest in one set subject, the elective opportunities allow for hands-on learning opportunities that benefit their graduation requirements while also allowing them to gauge their interest in a particular career.

“They’re going to finish with a certification that’s recognized in the workplace,” Craft said. “That said, many of them go on to add certifications.”

Throughout the next several months, The Sheridan Press will explore each track, describing how it fits into student life at SHS as well as the greater Sheridan community.

Mythbusters: Yes, home economics classes still exist | Local News | thesheridanpress.com - The Sheridan Press

Read More

Friday, November 26, 2021

Saving economics from itself - Times of India

The runaway power of global financial markets is now widely seen as a distorting force that deepens inequality and gives capitalism a bad name. What was the role of economists in sustaining ‘Frankenfinance’, many ask. Economics is too reliant on assumptions about calculating individuals (‘cogs’) while ignoring intangible values like the environment, say some. It’s all complicated math and abstracted models and ignorant of history and context, say others. Cogs And Monsters:What Economics Is, And What It Should Be, by British economist Diane Coyle, tries to reset its compass.

Many of these much-heard criticisms are straw-man arguments, she says, because academic economics has already changed in the last two decades. Mainstream economics is no longer a monolith, it now studies psychology and behaviour, the effects of technology, the power of institutions and culture and the long shadow of history. It has shifted its weight from macro to microeconomics, from theory to applied work.

Saving economics from itself - Times of India

Read More

Why Every Entrepreneur Should Study the Austrian School of Economics - Entrepreneur

Opinions expressed by Entrepreneur contributors are their own.

You're reading Entrepreneur United States, an international franchise of Entrepreneur Media.

Over 50 years ago, economist William Baumol noted that economics was a theory of the economy that left no place for entrepreneurship. Economic models, simply put, were “entrepreneur-less.” Economics is no better today; in fact, it’s arguably worse. It focuses on faceless economic forces in formalized models. Modern economics is to a great extent a theory of equilibrium and efficient outcomes. But it is not a theory of the market.

As economist Joseph Schumpeter argued, entrepreneurs are the lifeblood of the dynamic market economy. They are in the business of creating disequilibrium. They engage in “creative destruction.” The new that they create displaces the old and makes us better off. The market economy without entrepreneurship would be static, barren, and boring.

So what can entrepreneurs learn from economics? Not a whole lot. At least not from the highly mathematical modeling that is taught in intermediate and graduate level courses today. But there are other schools of thought that recognize the importance of the entrepreneur.

The Austrian school of economics

So-called Austrian economics, which was founded by scholars at the University of Vienna 150 years ago (hence the name), is an alternative approach to understanding the economy that embraces entrepreneurship and even sees it as the driving force of the market. To “Austrians,” as the followers of this tradition call themselves, the market is best understood as a process that is never in general equilibrium.

With entrepreneurship at the core, Austrians only reluctantly use mathematical modeling and statistical analysis. After all, if the economy is a dynamic process of entrepreneurship and innovation, of what use are mathematical equations? Instead, their focus is on value creation, uncertainty, and how producers constantly adjust and attempt to meet changing consumer preferences.

Austrian economics is an economic theory that is much more realistic than equilibrium models. For that reason, it is also much more helpful for entrepreneurs.

Economics for entrepreneurs

Few entrepreneurs have heard of or studied Austrian economics. But my experience is that most entrepreneurs are Austrians without knowing it. They have learned from experience how the economy works and have developed an intuition. Their gut feeling, sometimes referred to as entrepreneurial judgment, is a tacit understanding of the economy as a market process and what this means for entrepreneurship.

Here are four insights from Austrian economics that are part of that entrepreneurial intuition:

1. Consumer sovereignty

Not only is the customer king, but all production aims to ultimately satisfy consumers in some sense by providing them with value. This value is entirely up to the consumer. Entrepreneurs can only provide the means, typically a good or a service, that help consumers become better off. Sometimes this requires educating the customer so that they understand the value of the product. And, typically, the value lies in their complete experience, not just what you sell.

Related: How to Think Like a Successful Entrepreneur

2. Value determines price and costs are a choice

With value being in the eyes (and experience) of the consumer, the price they are asked to pay must be (much) lower. The entrepreneur’s job is to figure out at what price their product is attractive, and then choose a cost structure that allows for profit. In other words, the price is a guess based on what value consumers see in the product. The only choice is cost: how to produce at costs below the selling price and, ultimately, whether to produce.

Related: How to Become an Entrepreneur Who Doesn't Think About Costs

3. Entrepreneurship is about creating tomorrow

Leading Austrian economist Ludwig von Mises noted in his tome Human Action that “the ultimate source from which entrepreneurial profit and loss are derived is the uncertainty of the future constellation of demand and supply.'' What that means is individual entrepreneurs choose costs in the present to produce a product that must be sold in the near or distant future, whatever the market situation might be. That’s the uncertainty borne by the entrepreneur.

4. Seek to be a good monopolist

In standard economics models, competition is about offering the same or nearly the same goods competing on price. This is a terrible strategy for entrepreneurs, whose superpower is to facilitate value. Therefore, Austrians think of competition differenlty: It is about figuring out how to provide the best value experience possible. This often involves thinking out of the box and trying something new. Every innovation is by definition a new, unique offering and therefore also a monopoly. What benefits consumers most is entrepreneurs who aim tobe good monopolists.

Related: Entrepreneurs Should Aim to Be Good Monopolists

Standard economics has turned its back on and developed models that exclude entrepreneurship. As Joseph Schumpeter, schooled in the Austrian tradition, put it: the market economy without entrepreneurship is much “like Hamlet without the Danish prince.” Indeed, entrepreneurs are the main characters in the drama that is the economy. An economic theory that recognizes this not only does a better job explaining the economy -- it is also a useful framework for entrepreneurs.

Why Every Entrepreneur Should Study the Austrian School of Economics - Entrepreneur

Read More

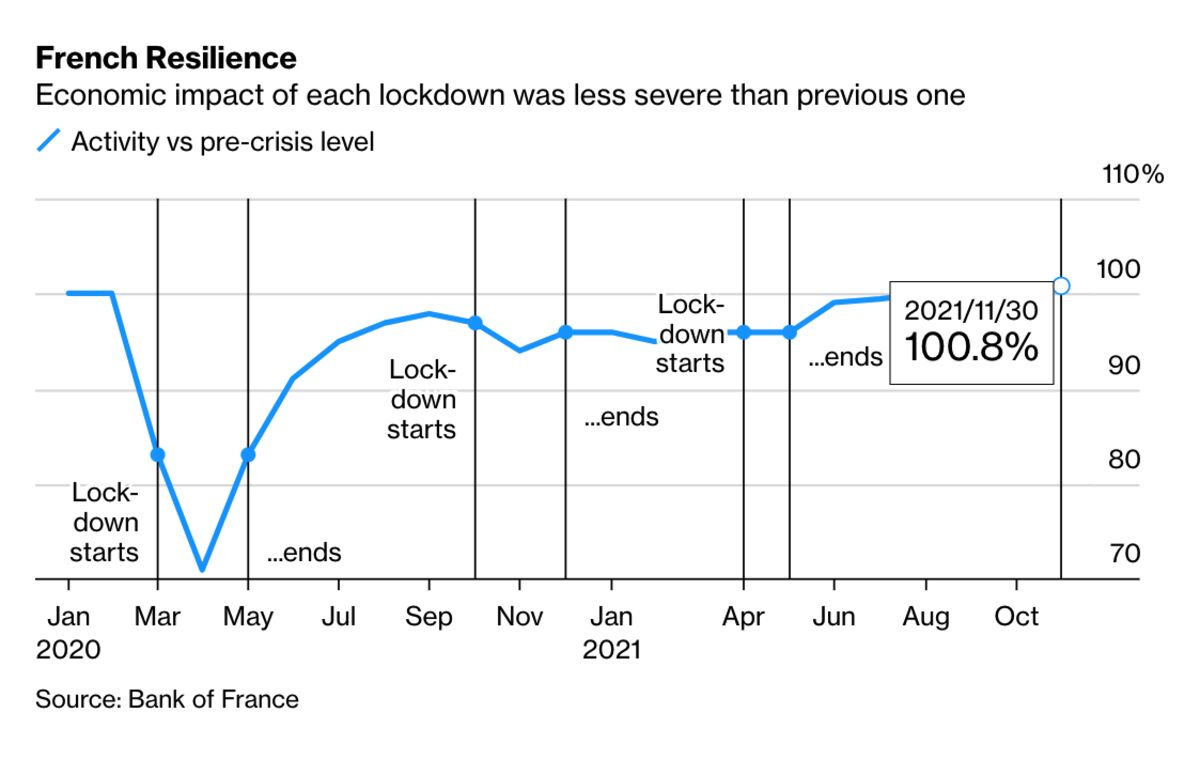

New Variant Will Test Europe's Economic Resilience to Lockdown - Bloomberg

Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast.

The new coronavirus variant is set to test the European economy’s recent ability to withstand fresh restrictions on activity.

New Variant Will Test Europe's Economic Resilience to Lockdown - Bloomberg

Read More

Thursday, November 25, 2021

China's Property-Led Economic Slowdown Shows No Signs of Ending - Bloomberg

China’s economy continued to slow in November with car and homes sales dropping again as the housing market crisis dragged on.

That’s the outlook from Bloomberg’s aggregate index of eight early indicators for this month. While the overall number stayed unchanged, under the surface there was a further deterioration in some of the real-time economic data.

China's Property-Led Economic Slowdown Shows No Signs of Ending - Bloomberg

Read More

What is the Future of Economics? - Masterstudies News

"Economics is everywhere," says Tyler Cowen, an American economist and professor. "And understanding economics can help us make better decisions and live happier lives." Ben Bernake, the former Chair of the US Federal Reserve, agrees. He says, "The ultimate purpose of economics is to understand and promote the enhancement of well-being." Given the recent economic shock of COVID-19, these words are more important than ever. They take on an even greater significance when we consider the calls for a new form of economic growth based on inclusion and sustainability. So with all that in mind, here's a look at the future of economics and one leading business school producing the kind of graduates every 21st-century business or organization needs.

What is economics?

Economics is concerned with the production, distribution, and consumption of goods and services. It examines how individuals, businesses, governments, and other institutions distribute and allocate resources. Generally speaking, economics can be broken down into macroeconomics, which looks at the economy as a whole, and microeconomics, which is concerned with businesses and people.

In other words, economics isn't just about money. It's also interested in human behavior and people's choices. Traditional economics supposes individuals make economic decisions rationally; they choose the option offering the most value. And it's the sum of these choices that make up our local and global financial markets. Some commentators believe economic choices and incentives are what define entire societies, for good or bad.

How economics is changing

But people don't always act rationally or in their best interest. Moreover, what defines a rational decision is often relative to external factors. To better understand these nuances of human behavior, economists came up with a new approach. It's called behavioral economics. Unlike classical economics, where decision-making is based on cold-headed logic, behavioral economics allows for “irrational” behavior and attempts to understand its root causes.

Behavioral economics also looks at how businesses and institutions can influence people's choices. In 2017, US academic Richard Thaler won the Nobel prize in economics for his pioneering work on 'nudge theory'. As controversial as it is innovative, this is the idea of how small measures can encourage individuals to make different decisions -- and therefore, due to the cumulation of many individuals, large changes in the economy and society. For example, the UK government recently started sending tax reminders in handwritten envelopes. This simple 'personal' touch helped bring in an extra £200 million in unpaid taxes every year.

Why study economics now?

It's an exciting time to be an economist. Some of today’s most revolutionary economic innovations include central bank digital currencies (CBDCs) a new type of virtual money issued directly by central banks. CBDCs could boost economic efficiency, increase financial inclusion, and reduce (or even eliminate) transaction fees. Over 80% of central banks are looking into CBDCs. At the same time, cryptocurrencies like Bitcoin and Ethereum are becoming mainstream, ushering in a new age where money, assets, and even property are being dematerialized.

Then there’s development economics. At a time where we face the United Nations’ universal call to action to end poverty, protect the planet, and ensure that by 2030 all people enjoy peace and prosperity, development economics studies the ways to achieve the Sustainable Development Goals.

Economies need to grow in the right way

Economic growth doesn't mean anything if it leaves people behind. And it will mean even less if it ignores other vital factors, such as its environmental impact. This is why experts and economists from all over the world are emphasizing the need for a green, post-COVID recovery powered by sustainable technologies and policies.

Launched by the United Nations, the Environmental, Social, and Corporate Governance (ESG) is a framework that allows investors to identify socially conscious projects or companies. Also known as sustainable investing or impact investing, the ESG investment economy is growing fast, especially among younger entrepreneurs and venture capitalists. According to a recent report from US SIF Foundation, investors now hold $17.1 trillion in assets chosen according to ESG criteria. The same figure was ‘only’ $5 trillion just three years ago.

"Investors used to have to compromise between ethics and returns,” says David Doughty, Chief Executive of Excellencia. "ESG investing changes that. Businesses can now be ethical and offer great returns. And the industry is booming. ESG is arguably one of the most exciting and critical areas to be in for the foreseeable future.”

Nova School of Business & Economics

Nova School of Business & Economics has a range of innovative, world-class programs aimed at students and professionals interested in a career in economics.

Ranked the third best Master’s in Economics in Europe, Nova SBE’s Master’s in Economics is a one-year course combining rigorous analysis of social and economic issues with a hands-on, practical approach to problem-solving and policy-making. Learning modules include behavioral economics, development economics, financial economics, and empirical macroeconomics. Students interested in sustainability issues can study modules on impact investing, environmental policy, or sustainable finance.

By the end of the course, students have the knowledge and skills to apply state-of-the-art theoretical and empirical techniques to real-life policy issues, putting them in a prime position to land exciting professional roles. This is why 100% of its graduates find work within six months of graduating, with 62% of those working internationally.

Nova School of Business & Economics also offers a Master's in International Development & Public Policy It's tailored for high-quality international students with a background in social sciences, humanities, management, political science, or engineering. Students learn about economics, management, political science, and the quantitative methods used in assessing and directing public policy. It's the ideal option for students interested in the socio-economic context of public policy-making. Graduates are qualified to work for international organizations such as the United Nations, policy-making consultancy firms, public relations agencies, and government or non-governmental organizations.

Future innovators and impact-driven students can hone their natural talents by enrolling in Nova SBE's Master’s in Impact Entrepreneurship & Innovation. Dedicated to nurturing the next generation of socially-conscious market disruptors, the course blends theoretical learning and practice, helping students develop their ideas into exciting new businesses or develop solutions to social problems within the organization they work for. It's a course for ambitious entrepreneurs an entrepreneurial and intrapreneurial mindset with a passion for doing things differently.

Located in Lisbon, Portugal, Nova School of Business & Economics is one of the best business schools in the world. All classes are taught in English by renowned faculty with years of real-world experience. The school has 3,000 students from more than 70 different countries, creating a lively, multicultural, and welcoming community that embraces diversity and carries out its unique Nova Way of Life.

The campus benefits from the fantastic Lisbon weather and invites students to go outside as much as they want, given that it is just a short walk from the beach and many of Lisbon's best attractions, including the trendy Bairro Alto and Cais do Sodré neighborhoods. These are home to artsy hip stores during the day, and a wide variety of bars and restaurants during the night., so they're a great place to be embraced by this culture and hang out after class.

Ilaria graduated from Nova SBE with a Master's in International Management earlier this year. She says, “Nova [SBE] is an amazing university, very international, people come from everywhere and the teachers are super competent. It's the best university in Portugal according to the statistics and I totally agree.”

Flavia moved from Chile to study business and economics at Nova [SBE]. "I came here because I heard it was a great school and it matched all my expectations. I liked the activities to welcome the exchange students, the international department really puts a lot of effort into it,” says Flavia. "The campus is the perfect studying environment. I recommend any future students to come here. And life in Lisbon is great. There are many things to do here!"

For more information on when and how to enroll in any of these courses, visit Nova SBE's admissions page today.

Article written in association with Nova School of Business & Economics.

What is the Future of Economics? - Masterstudies News

Read More

Covid surge threatens Europe's economic recovery - CNN

London (CNN Business)A resurgence of coronavirus cases across Europe is feeding fears that the region's strong economic recovery from the pandemic could be jeopardized by another tough winter.

Stagnation ahead?

Covid surge threatens Europe's economic recovery - CNN

Read More

'Y' is it gone?: Series stymied by economics, pandemic; makers hope another network will pick it up - Albuquerque Journal

You have questions. I have some answers.

Q: I was shocked to hear that the FX on Hulu series “Y: The Last Man” was abruptly canceled! What happened?? I was enjoying the show, and looking forward to more episodes and seasons! Is there hope another streaming channel will pick this up? It cannot just leave off with episode 10!

Q: I was shocked to hear that the FX on Hulu series “Y: The Last Man” was abruptly canceled! What happened?? I was enjoying the show, and looking forward to more episodes and seasons! Is there hope another streaming channel will pick this up? It cannot just leave off with episode 10!

A: The drama fell prey to economics, according to the Hollywood Reporter. Long delayed by off-camera changes and COVID, the show had reached a point where it would have to pick up the contract options for the cast while not knowing if, in fact, the show would keep going. “Ultimately, FX brass declined to pay $3 million to further extend options,” said the publication. But the makers of the show have held out hope that someone else will pick it up, and the Hollywood Reporter noted that HBO Max might be a good fit because of corporate ties between the show and the streamer. Showrunner Eliza Clark said, “It is the most collaborative, creatively fulfilling and beautiful thing I have ever been a part of. We don’t want it to end.”

Q: I enjoyed “Last Tango in Halifax” immensely. Can you tell me if it will be coming back?

A: The series starring Derek Jacobi and Anne Reid ended in 2020.

Q: I read recently that actor Sam Rockwell celebrated his 53rd birthday. At 88 years old, I am still a fan of the B Westerns of my youth and wondered if Sam Rockwell is related to the character actor Jack Rockwell, who appeared in so many of those old movies.

A: Sam Rockwell, an Oscar winner for his performance in “Three Billboards Outside Ebbing, Missouri,” does have an acting bloodline as the son of actors Pete Rockwell and Penny Hess. But I have not connected them to Jack Rockwell, the actor you recalled.

Q: Our question is about the television show “Timeless.” Is there any hope of a revival or will someone be streaming the episodes?

A: I do not know of any plans for a revival of the time travel drama. You can find the old episodes streaming on Hulu, including the series finale.

Do you have a question or comment about entertainment past, present and future? Write to Rich Heldenfels, P.O. Box 417, Mogadore, OH 44260, or brenfels@gmail.com. Letters may be edited. Individual replies are not guaranteed.

'Y' is it gone?: Series stymied by economics, pandemic; makers hope another network will pick it up - Albuquerque Journal

Read More

Spain's Economic Revival May Be Stronger Than It Looks - Bloomberg

Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast.

A booming jobs market and surging tax revenue have economists arguing that disappointing data don’t accurately reflect the speed of Spain’s recovery from the euro area’s deepest recession.

Spain's Economic Revival May Be Stronger Than It Looks - Bloomberg

Read More

Wednesday, November 24, 2021

Economics and sausage | Opinion | times-journal.com - Times-Journal

[unable to retrieve full-text content]

Economics and sausage | Opinion | times-journal.com Times-JournalEconomics and sausage | Opinion | times-journal.com - Times-Journal

Read More

Economists cut Canada growth forecasts on floods, but see rate hikes on track - Reuters

/cloudfront-us-east-2.images.arcpublishing.com/reuters/HU4BQNZPPZNFZGM3A3T2LONHUU.jpg)

A flood affected road is seen after rainstorms lashed the western Canadian province of British Columbia, triggering landslides and floods, shutting highways, in Abbottsford, British Columbia, Canada November 21, 2021. REUTERS/Jennifer Gauthier/File Photo

Register now for FREE unlimited access to reuters.com

OTTAWA, Nov 24 (Reuters) - Floods that wiped out bridges, roads and rail lines in British Columbia will hurt Canada's economic growth and fuel inflation in the fourth quarter, but the Bank of Canada's rate-hike timing is likely to remain unchanged, economists said.

"We are trying to wrap our arms around this complex situation, and waiting to see just how long-lasting some of the blockages are," said Doug Porter, chief economist at BMO Capital Market Economics.

Porter halved his fourth quarter growth estimate to 3.0% from a year earlier. That drags down his full-year growth forecast to 4.8%, from a previous forecast of 5.0%, because of the floods and global supply chain disruptions.

Register now for FREE unlimited access to reuters.com

"For the Bank of Canada, it's not obvious that the weaker growth figures will have much impact as they have hit the supply side and actually threaten to boost inflation even further," he added.

Economists are clear the flooding will have a material impact on near-term gross domestic product forecasts, but there is considerable uncertainty about how fast growth could bounce back.

It will take time to fully repair the infrastructure needed to transport goods across the mountainous Pacific coast province, but key rail lines are set to reopen this week.

"Quantifying the overall economic impact when the situation is still in flux is fraught with uncertainty," said Jimmy Jean, chief economist at Desjardins Group, in a note.

Jean said that 2013 floods in Alberta undermined growth the month they hit, but then quickly rebounded.

"A rapid economic recovery following natural disasters is fairly typical," Jean said.

The Bank of Canada last month - before the floods - cut its growth forecasts and signaled rate hikes could start in the "middle quarters" of 2022.

The central bank warned inflation would go higher this year before easing back to the 2% target in late 2022. Canada's annual inflation rate hit 4.7% in October, the seventh straight month above the central bank's 1-3% control range.

"The inflationary shock will be more of a pressing concern for (the central bank) and will keep them on track," said Simon Harvey, senior FX market analyst at Monex Canada.

Money markets expect the Bank of Canada to start hiking rates in March 2022 with a total of five increases next year, but Stephen Brown, senior Canada economist at Capital Economics, questioned that pace.

"The hit to activity from the devastating floods in B.C. this week reduces the chance of the Bank becoming more hawkish any time soon," Brown said in a note.

Register now for FREE unlimited access to reuters.com

Reporting by Julie Gordon in Ottawa; Editing by Steve Scherer and David Gregorio

Our Standards: The Thomson Reuters Trust Principles.

Economists cut Canada growth forecasts on floods, but see rate hikes on track - Reuters

Read More

Atlanta Fed chief to head chamber in 2022, sees diversity as economic fuel - The Atlanta Journal Constitution

AJC - Logo - Main logo_ddn_tag_Site JN with T...

-

Sooner or later, AI-economist machines will replace human economists in many areas. Unsupervised or reinforcement learning algorithms th...

-

Enlarge this image The Sadie Collective Dr. Sadie Alexander became America's first Black economist in 1921. But after receiv...

-

Over the past few months, a handful of Republican lawmakers have embraced economic policies that, not long ago, would have been unthinkable...